Chicago Divorce Lawyer

Navigating Divorce in Chicago: Tips from a Top Lawyer

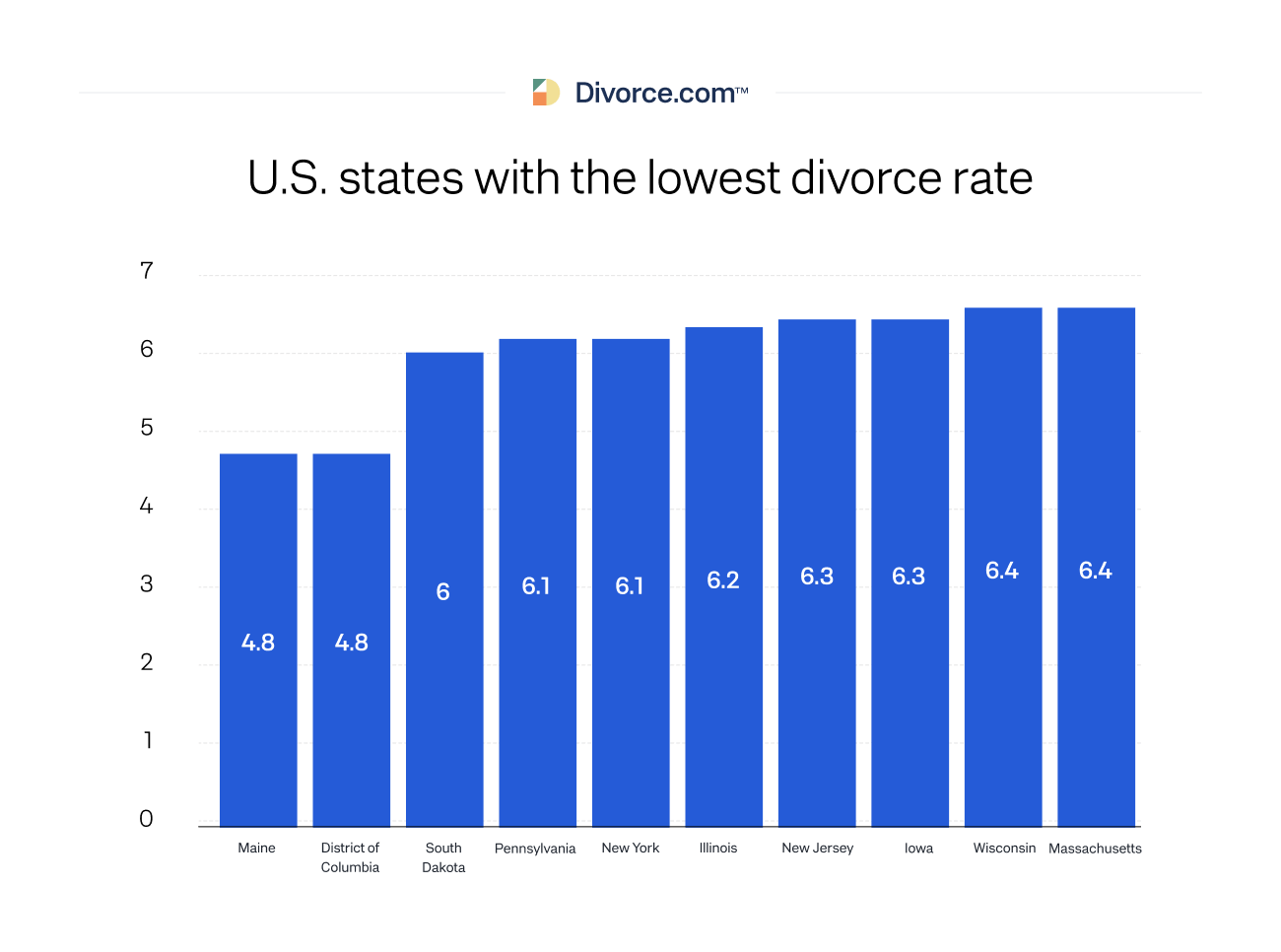

Divorce is never an easy process, and it can be especially difficult to navigate in a state like Illinois where a quick Google search for “Illinois Divorce Lawyer” brings up 18,100,000 results. Plus, the complex legal system, coupled with the emotional turmoil of separating from your spouse, can make the whole ordeal seem even more overwhelming.

However, with the help of a top Chicago divorce lawyer, you can navigate this challenging period and help achieve a positive outcome for you and your family. Here are some tips from our Chicago-based law firm, Masters Law Group, on how to navigate divorce in Chicago.

Choose the Right Lawyer

One of the most important decisions you’ll make during the divorce process is choosing the right lawyer.

When seeking a divorce lawyer, reliability is essential. It is vital to evaluate how effectively they communicate with you to establish a positive relationship. A strong rapport is crucial because divorce cases can take several months to settle. While the lawyer’s goal should not be excelling in personability and charm, (it should be excelling in family law, especially divorce law), it is important that you trust and respect their professional advice and want to work with them.

Throughout the process, you may have multiple questions, concerns, or disputes, and you require someone who can ease your worries. At Masters Law Group, we begin by understanding your goals for the divorce and how you wish to feel once the process is complete. We discuss your objectives in detail to provide exceptional legal representation. Additionally, we offer free consultations to help you evaluate if we are the right fit for your needs.

Gather Necessary Documentation

Once you’ve decided on a family law attorney, be prepared and gather any necessary documentation that your lawyer will need to build your case. This includes financial records, such as bank statements, tax returns, investment accounts, and real estate records. You should also provide your lawyer with any evidence you may have that supports your case. Such as text messages or emails that demonstrate your spouse’s infidelity or neglectful behavior.

When it comes to property division, it’s important to make a list of all assets and debts that you and your spouse share. This includes assets that are solely in your name or your spouse’s name. This includes everything from retirement accounts and investments to real estate and personal property. Having a detailed inventory of your assets will help your lawyer build a stronger case and ensure that you receive a fair settlement.

It’s also crucial to be honest with your lawyer about any challenges you may face during the divorce process. This includes concerns about child custody or your spouse hiding assets or income (including digital assets like cryptocurrencies. Being upfront and honest with your lawyer in the long run will only help you achieve a positive outcome.

Consider Mediation

Mediation can be an effective way to reach a settlement in a divorce case, without the need for a lengthy and expensive court battle. The mediator’s role is to facilitate the negotiation process, help both parties understand each other’s perspectives, and explore alternative options for resolving disputes. The mediator does not make any decisions for either party but instead works to ensure that both parties have equal opportunities to voice their opinions and arrive at a mutually agreeable outcome.

Mediation can be an effective option for couples who are willing to work together and compromise to achieve a positive outcome. It’s particularly useful for couples who have children, as it can help reduce the stress and trauma that children often experience during a divorce.

Working With Masters Law Group

If you’re looking for a top lawyer in Illinois, consider working with the skilled attorneys at Masters Law Group.

Masters Law Group is located in downtown Chicago, covering divorce cases in Cook County and surrounding regions. Our areas of focus include divorce, allocation of parental responsibilities, and other family law issues.

Our firm has earned a top spot on the list of Best Law Firms 2023 by Best Lawyers® and U.S. News & World Report, and we are highly esteemed and respected by leading peer review publications such as Best Lawyers, Super Lawyers, and Leading Lawyers. Furthermore, our senior attorneys, Erin E. Masters and Anthony G. Joseph, have been recognized by these prestigious publications year after year, showcasing their strong work ethic, character and skill in family law; ensuring that you have someone you can trust on your side during your divorce.

If you’re considering a divorce in the state of Illinois, you don’t have to go it alone. Having the right attorney fighting in your corner can make a significant difference to the outcome of your case. At Masters Law Group, we are dedicated to helping our clients achieve the best possible outcome in their divorce proceedings.

Contact us today to schedule your complimentary consultation.